Insights on emergency fund best practices for everyone

An emergency fund is a savings account designated for unexpected expenses, like medical emergencies or job loss, recommended to cover three to six months of living costs for financial security.

Insights on emergency fund best practices can really transform how we handle unexpected financial blows. Have you ever faced an unexpected expense and wished you had planned better? This article will guide you through the essentials of creating a robust emergency fund.

Understanding what an emergency fund is

Understanding what an emergency fund is essential for financial stability. An emergency fund is a savings account that is specifically set aside for unexpected expenses, such as medical bills, car repairs, or job loss. Having an emergency fund can provide peace of mind and protect you from going into debt during tough times.

Importance of an Emergency Fund

Why is having an emergency fund so crucial? Without an emergency fund, individuals may find themselves relying on credit cards or loans, which can lead to stress and financial instability. An emergency fund can help you:

- Cover unexpected expenses without borrowing.

- Reduce financial anxiety.

- Provide security for larger life changes.

To effectively manage an emergency fund, it’s essential to determine how much money you will need. A common rule is to save three to six months’ worth of living expenses. The amount might vary depending on personal circumstances, such as job stability and health conditions. This fund should be easily accessible but not too tempting to dip into for non-emergencies.

How to Build an Emergency Fund

Building an emergency fund doesn’t happen overnight. It requires planning and discipline. Start by setting a specific goal and break it down into smaller, manageable steps. Consider automating your savings to consistently set aside a portion of your income each month. This way, saving becomes effortless, and you can watch your fund grow over time.

A great strategy is to treat your emergency fund like a regular bill. Commit to saving a certain amount each payday, and you will soon see the benefits of safeguarding your financial future. Remember, the key to a successful emergency fund is consistency and patience. In time, with careful planning, you will have a safety net to lean on when unexpected expenses arise. By understanding the importance of an emergency fund, you can take proactive steps to secure your financial wellbeing.

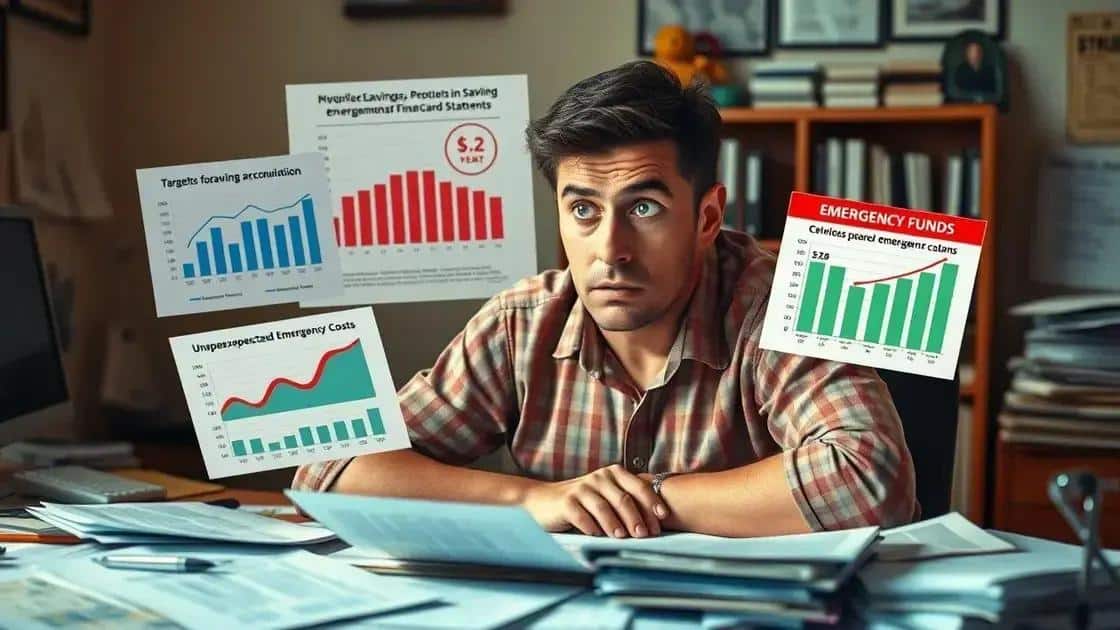

How to calculate your ideal emergency fund

How to calculate your ideal emergency fund can be a straightforward process. It involves understanding your monthly expenses and knowing how much you need to save to cover unexpected events. Start by reviewing your living costs, which typically include rent or mortgage, utilities, food, transportation, and insurance.

Assess Monthly Expenses

To establish a solid foundation for your emergency fund, first calculate your total monthly expenses. List out all essentials, focusing on:

- Housing costs (rent/mortgage)

- Utilities (electricity, water, gas)

- Groceries and essentials

- Transportation costs (gas, public transport)

Adding these figures will give you a clear understanding of your baseline expenses. Knowing this number is crucial to setting up your ideal fund.

Determine Your Fund Size

A general rule is saving three to six months’ worth of living expenses. If your job is stable and you have fewer financial obligations, you might stick with three months. However, if your situation is more uncertain—like being self-employed or in a volatile industry—lean towards six months or even more.

For instance, if your total monthly expenses amount to $3,000, your emergency fund should ideally range from $9,000 to $18,000. This ensures you have a buffer to fall back on without causing additional financial strain during emergencies.

Adjusting For Personal Circumstances

It’s also important to personalize your fund based on your own situation. Consider factors such as job security, health, and family responsibilities. If you have dependents or live in an area with higher costs, you may want to increase your savings target. Additionally, revisit your estimate regularly, especially after significant life changes like a new job or relocation.

Ultimately, calculating your ideal emergency fund empowers you to be proactive. By understanding your financial needs and setting realistic goals, you create a safety net that leads to greater peace of mind and security.

Tips for building your emergency fund effectively

Building your emergency fund effectively requires strategy and commitment. To ensure you are saving enough money for unforeseen circumstances, you need to establish a clear plan. Start by determining how much money you want in your fund and set realistic goals to reach that amount.

Create a Budget

The first step in building your fund is to create a detailed budget. This will help you visualize your income and expenses, allowing you to identify areas where you can cut back. Focus on:

- Tracking monthly income and expenses.

- Identifying non-essential expenses.

- Setting aside a specific amount for savings each month.

Once you have a budget in place, stick to it diligently. This discipline will make a significant difference in reaching your emergency fund goal.

Automate Your Savings

One of the best ways to build your emergency fund is to automate your savings. By setting up automatic transfers from your checking account to your savings account, you ensure that money goes directly into your fund without requiring additional effort. This could be a fixed amount each month or a percentage of your paycheck, making saving easier and more effective.

Consider scheduling these transfers right after payday, as this helps you save before you even have a chance to spend that money. It transforms saving into a seamless part of your financial routine.

Set Realistic Short-Term Goals

While building a substantial emergency fund is the ultimate goal, breaking it down into smaller, short-term goals can make it more manageable. For instance, aim to save $1,000 as your first milestone. Once you achieve it, set your sights on the next target, gradually working towards your overall goal.

These short wins not only motivate you but also provide a sense of accomplishment as you watch your savings grow. Each milestone achieved strengthens your financial security.

Lastly, always review your progress regularly. If your financial situation changes, adjust your savings rate accordingly. This adaptability will keep you on track, ensuring that your emergency fund remains a priority in your financial planning.

Common misconceptions about emergency funds

There are several common misconceptions about emergency funds that can cloud understanding and hinder effective savings. Many people believe they only need to save a small amount or that these funds aren’t necessary at all. Understanding the truth can help you make better financial decisions.

Myth 1: I Don’t Need an Emergency Fund

Some individuals think they won’t have unexpected expenses. However, life is unpredictable, and emergencies can occur without warning. Medical bills, car repairs, or sudden unemployment can happen to anyone. Having an emergency fund ensures that you are prepared for the unexpected and can handle financial shocks without stress.

Myth 2: $1,000 is Enough

While saving $1,000 is a great start, it may not be sufficient for most people. The ideal amount for your emergency fund should be three to six months’ worth of living expenses. This varies depending on your unique situation, but it’s important to calculate your real needs instead of settling for a blanket amount.

Myth 3: I Can Use Credit Cards Instead

Some believe that credit cards can act as a safety net for emergencies. While credit cards can be helpful, they can also lead to debt accumulation. Using credit may result in high interest rates and additional financial strains during emergencies. An emergency fund provides immediate access to cash without the worry of paying back debt later.

Myth 4: It’s Too Hard to Save

Many people feel intimidated by the thought of saving for an emergency fund. However, it’s easier than it seems. Start small and gradually increase your savings as you adapt to a new budget. Automating savings is a powerful tool that makes the process smoother. Setting aside a small percentage of your income regularly can help you build a substantial fund over time.

By debunking these misconceptions, you’re better equipped to prioritize and establish your emergency fund. Understanding the true purpose and benefits of having funds set aside can provide peace of mind and enhance your overall financial health.

In conclusion, having a well-established emergency fund is vital for securing your financial future. By understanding common misconceptions, you can take actionable steps to create and maintain a strong safety net. Remember, it’s not just about saving money; it’s about preparing for life’s uncertainties. Start small, stay consistent, and soon you will find confidence in your financial resilience. Prioritizing your emergency fund today can lead to peace of mind tomorrow.

FAQ – Frequently Asked Questions about Emergency Funds

What is an emergency fund?

An emergency fund is a savings account specifically set aside for unexpected expenses, such as medical emergencies or job loss.

How much should I save in my emergency fund?

It’s recommended to save three to six months’ worth of living expenses as your emergency fund to cover potential unexpected costs.

Can I use credit cards instead of an emergency fund?

While credit cards can help in emergencies, they can lead to debt. An emergency fund provides immediate cash without the stress of repayment.

How can I start building my emergency fund?

Start by creating a budget, setting savings goals, and consider automating transfers to your savings account to grow your fund consistently.