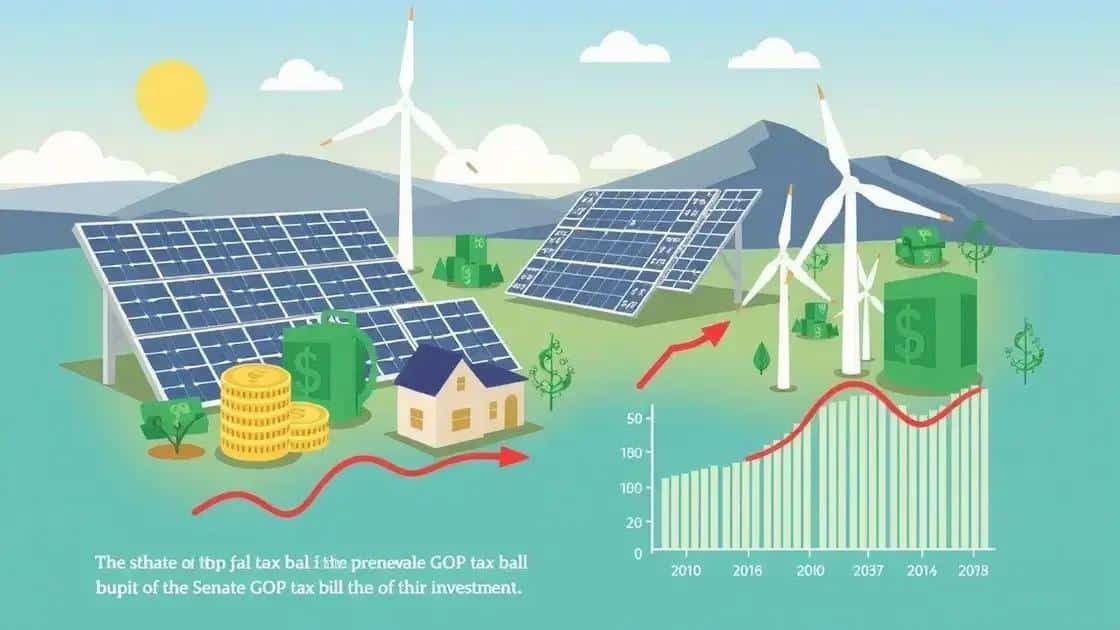

Senate GOP tax bill cuts clean energy credits

The Senate GOP tax bill cuts clean energy credits, risking investment in renewable projects, increasing energy prices for consumers, and threatening the overall growth and stability of the clean energy market.

Senate GOP tax bill cuts clean energy credits are raising concerns among environmental advocates and industry leaders alike. With potential shifts in policy, how will this affect renewable energy initiatives and investments? Let’s dive into the details.

Overview of the Senate GOP tax bill

The Senate GOP tax bill has sparked considerable debate and analysis among lawmakers and citizens alike. Understanding its implications is crucial for those invested in the clean energy landscape.

Key Components of the Bill

This tax bill is designed to reduce tax burdens on corporations and individuals. Some of the most significant provisions include:

- Lower corporate tax rates

- Changes to individual tax brackets

- Elimination of specific deductions and credits

- Impact on state tax deductions

The proposed cuts to the clean energy credits are particularly alarming. Advocates argue that these credits have been pivotal in promoting renewable energy sources.

Impact on Clean Energy

One of the primary justifications for clean energy incentives is to encourage investment in renewable technology. By slashing these credits, the bill could stifle innovation and growth in the sector. The clean energy market relies heavily on these financial boosts to sustain projects.

Additionally, the elimination of credits might hinder progress in addressing climate change. If less funding is available for renewable projects, we risk falling behind in our sustainability efforts.

In conclusion, the Senate GOP tax bill presents a mixed bag of benefits and drawbacks. While it aims to simplify taxation, its impact on clean energy is a cause for concern that warrants further examination.

Impacts on clean energy investments

The impacts of the Senate GOP tax bill on clean energy investments are significant and multifaceted. With cuts to clean energy credits, many stakeholders are worried about the future viability of renewable projects.

Reduction in Funding

A decrease in clean energy credits means less funding for new projects. This could lead to delays or cancellations of initiatives that are crucial for developing sustainable energy sources.

- Less investment in solar and wind technologies

- Fewer jobs created in the renewable sector

- Potential increase in reliance on fossil fuels

- Stagnation of technological innovation in clean energy

Investors may hesitate to put money into clean energy ventures without the incentives that credits provide. The risks associated with financing new technologies could outweigh potential gains.

Market Uncertainty

Furthermore, the uncertainty surrounding government support can dissuade companies from committing to long-term projects. When investors cannot predict future returns due to policy changes, they might shift their focus to more stable, traditional energy sources. This could have lasting effects on the growth of the clean energy sector, impacting the job market and progress in reducing carbon emissions.

As the landscape shifts, there is a growing concern that the clean energy sector will struggle to attract necessary capital. Sustainable growth requires strong foundations, and uncertainty in fiscal support can erode investor confidence.

Key areas cut in clean energy credits

Several key areas are affected by the cuts to clean energy credits outlined in the Senate GOP tax bill. These cuts can have widespread implications for the renewable energy sector.

Types of Clean Energy Credits Affected

One of the most significant aspects is the reduction in funding for specific credit programs. Notable cuts include:

- The Investment Tax Credit (ITC) for solar energy

- The Production Tax Credit (PTC) for wind energy

- Credits for energy efficiency improvements

- Support for electric vehicle incentives

These reductions are particularly troubling for companies relying on these credits to secure financing for new projects.

Impact on Renewable Energy Projects

The eliminations create uncertainty, leading to potential delays or scaling back of projects. Without financial support, many developers may reconsider their investment in clean energy technologies. This hesitance may disrupt the momentum gained in the past decade towards renewable energy expansion.

Stakeholders in the energy market recognize the importance of these credits for fostering innovation. By cutting funding, we risk losing technological advances and the jobs associated with them. The renewable energy sector needs stable support from federal policies to thrive.

Moreover, the lack of these credits can deter new entrants into the clean energy market. Start-ups and small businesses often depend on financial incentives to launch their initiatives. A decrease in available credits may stifle competition and innovation, ultimately hurting consumers.

Future implications for renewable energy market

The future implications for the renewable energy market due to changes in the Senate GOP tax bill are profound. As the landscape alters, key areas will experience significant shifts that could affect everyone from industry leaders to everyday consumers.

Investment Trends

With the potential for reduced clean energy credits, investment trends are predicted to change dramatically. Investors typically seek stability and return on investment, and uncertainty around tax credits can lead them to reconsider funding in renewable projects. This could result in:

- Increased investment in fossil fuels as a safer option

- Delayed projects in solar and wind energy

- Fewer new entrants in the renewable sector

- Consolidation among existing companies due to financial strain

These shifts could hinder growth and innovation in clean technologies, making it harder to transition away from traditional energy sources.

Market Competition

As the clean energy sector grapples with these challenges, competition may tighten. Companies that can adapt quickly to the changing financial landscape will likely thrive. In contrast, those that rely heavily on credits may struggle to survive. This disparity could lead to:

- A divide between large corporations and startups

- Innovative solutions emerging from agile companies

- Potential job losses in sectors heavily dependent on credits

Ultimately, consumers may face increased prices for renewable energy if the competition decreases. The balance of supply and demand will play a crucial role in determining the future landscape.

As the renewable energy market evolves, the need for policy changes becomes evident. Advocates for clean energy highlight that stable support is necessary to ensure the sustainable growth of these industries. With the right incentives, the transition to renewable energy can be a successful path forward for the economy and the environment.

FAQ – Frequently Asked Questions about the Senate GOP Tax Bill and Clean Energy

What is the impact of the Senate GOP tax bill on clean energy credits?

The bill proposes cuts to clean energy credits, which could reduce funding for renewable projects and slow down investments.

How might these cuts affect renewable energy prices for consumers?

Cuts to clean energy incentives may lead to decreased competition, potentially resulting in higher prices for renewable energy.

What should companies in the renewable sector do in response to these changes?

Companies should adapt by exploring new funding strategies and innovations to stay competitive in a changing market.

Why is policy stability important for the renewable energy market?

Stable policies are crucial to ensure continued investment and growth in the renewable energy sector, supporting the transition away from fossil fuels.